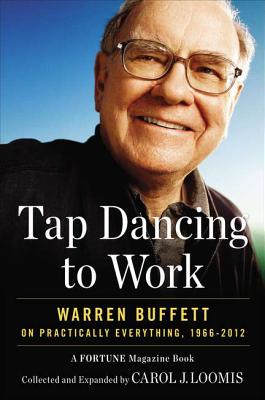

Warren Buffett built Berkshire Hathaway into something remarkable— and Fortune journalist Carol Loomis had a front-row seat for it all. When Carol Loomis first mentioned a little-known Omaha hedge fund manager in a 1966 Fortune article,

she didn’t dream that Warren Buffett would one day be considered the

world’s greatest investor—nor that she and Buffett would quickly become

close personal friends. As Buffett’s fortune and reputation grew over

time, Loomis used her unique insight into Buffett’s thinking to

chronicle his work for Fortune, writing and proposing scores of

stories that tracked his many accomplishments—and also his occasional

mistakes. Now Loomis has collected and updated the best Buffett articles

Fortune published between 1966 and 2012, including thirteen

cover stories and a dozen pieces authored by Buffett himself. Loomis has

provided commentary about each major article that supplies context and

her own informed point of view. Readers will gain fresh insights into

Buffett’s investment strategies and his thinking on management,

philanthropy, public policy, and even parenting. Some of the highlights

include:

- The 1966 A. W. Jones story in which Fortune first mentioned Buffett.

- The first piece Buffett wrote for the magazine, 1977’s “How Inf lation Swindles the Equity Investor.”

- Andrew Tobias’s 1983 article “Letters from Chairman Buffett,” the first review of his Berkshire Hathaway shareholder letters.

- Buffett’s stunningly prescient 2003 piece about derivatives, “Avoiding a Mega-Catastrophe.”

- His unconventional thoughts on inheritance and philanthropy, including his intention to leave his kids “enough money so they would feel they could do anything, but not so much that they could do nothing.”

- Bill Gates’s 1996 article describing his early impressions of Buffett as they struck up their close friendship.

No comments:

Post a Comment